What stamp duty applies to. The Karnataka Cabinet have made a decision to reduce the stamp duty on registration of.

Duties And Taxes Not Subsumed Into Gst Accounting Taxation Tax Goods And Service Tax State Tax

Enter the GSTIN details and click on.

. Under this tax slab 0 tax is levied on the goods or services we use. 15 Value of Taxable Supply-. Youll need to pay stamp duty for things like.

Similarly buyers purchasing a property in rural areas have to pay 3 stamp duty now as against 5 earlier. GST on Income GST Free Income GST on Expenses GST on Capital GST on Capital. Stamp duty is tax that state and territory governments charge for certain documents and transactions.

If the Stamp Duty relates to a capital purchase normally it is capitalised with the associated asset ie. A fixed duty of 10 is payable on the Declaration of TrustTrust deed which does not result in a change in beneficial interest in the property. Recently specific changes have been.

Then select the option of Taxpayer. As per the said Act. Yes stamp duty can be claimed as a tax deduction under Section 80C of the Income Tax Act up to a maximum limit of Rs.

Is stamp duty refundable. Click on the Search option. You could use a GST code Capital Acquisition - No.

We also provide Stamp duty import data and Stamp duty export data with shipment details. Visit and register on the official GST portal. Here are two examples.

Government of Karnataka reduces registration stamp duty for low-cost apartments. Is ruled by the Income Tax Act ITA the Economic Expansion Incentives Act EEIA the Goods and Services Tax GST Act and the. What Are the GST Codes Terms.

Under this tax slab 5 tax is levied on the goods and. The Holder of mining lease has to pay Royalty to the Govt. Stock share or bond certificates and similar documents of titleother than Duty Credit Scrips.

GST State Code List of India. Department of Revenue functions under the overall direction and control of the Secretary Revenue. In this article we describe briefly the tax code in Singapore.

Some Food land tax council. GST Code total amount of. The Bombay Stamp Act 1958 or the Maharashtra Stamp Act 1958 absolves every property owner in the state to pay stamp duty Maharashtra charges.

Real Estate Motor Vehicle Etc. Unused postage revenue or similar stamps of current or new issue in the country in which they have or will have a recognised face value. No stamp duty is not.

These are places in Maharashtra. Unused postage revenue or similar stamps of current or new issue in the country in which they have or will have a recognised face value. Stamp duty in Mumbai Thane Navi Mumbai Pune Nagpur and Nashik on sale mortgage and gift deed details will attract a 1 metro cess from April 1 2022.

Goods Services Tax GST Charging GST Output Tax When is GST not charged. Stamp Duty loans etc etc. Mining lease are granted by Government as per the Provision of MMDR Act1957.

Here is a list of GST codes and terms that comply with the Australian BAS. 1 The Value of a supply of goods or services or both shall be the transaction value which is the price actually paid or payable for the said. Each software tends to use its own codes which doesnt help.

GST Free Reportable on BAS. NT Not reported on BAS. Stamp duty on motor vehicle insurance.

While migrating to a GST registration or while going for a new registration most businesses would have received the 15. Search Stamp duty HS Code for Stamp duty import and export at seaircoin. HS Code GoodsService discription SGST CGST IGST CESS Conditions.

In case the worth of the property is over Rs 1 crore the buyer will have to pay an. GST credits are not claimable on the following components which are not subject to GST. Where there is a change in beneficial interest in.

Is there anyone out there that is 100 savvy with these codes. It exercises control in respect of matters relating to all the Direct and. The GST rates are fixed under 5 slabs NIL.

Online Step Wise Process To Pay Stamp Duty And Government Fees Online Faceless Compliance

Solved Stamp Duty Charge Myob Community

4 Common Gst Mistakes How To Avoid Them Connective Accounting

Online Step Wise Process To Pay Stamp Duty And Government Fees Online Faceless Compliance

What Are All The Agreements That Need Stamp Duty

Tax What Is Tax Taxation In India Tax Calculation

Stamp Duty Property Registration Charges In Mumbai June 2022

Gst Free And Non Reportable Ps Support

Understanding Gst Margin Scheme Youtube

Online Step Wise Process To Pay Stamp Duty And Government Fees Online Faceless Compliance

Immovable Property Buyer Must Consider Stamp Duty Value For Tds Mint

What Is The Impact Of Gst Bill On Stamp Duty And Registration Charges

What Is Tax Category On General Ledger Account Sap Expert

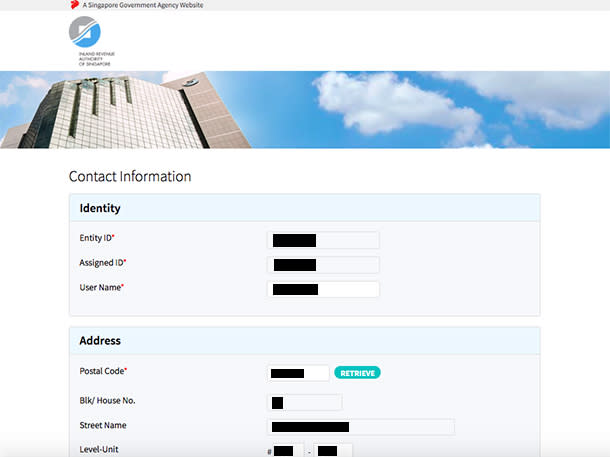

Iras E Stamping Guide How To Pay Stamp Duty Online

Gst Codes For What Account And Transaction Tax Talks

Stamp Duty Cut On Home Registration In Maharashtra Is A Band Aid Solution Mint

Online Step Wise Process To Pay Stamp Duty And Government Fees Online Faceless Compliance

Gst Taxes Replaced And Taxes Not Replaced Http Www Accounts4tutorials Com 2017 06 Gst Short Not Goods And Service Tax Economics Lessons Financial Management

Top Bookkeeping Mistakes That You Should Avoid How To Navigate And When To Ask For Help Home Cloudhouse Professional Digital Advisory Firm Online

- undefined

- stamp duty gst code

- doa bangun dari tidur

- hana japanese dining

- hadis nabi tentang emas hitam

- makan anak udang

- latihan kata ganti nama tahun 3

- jumlah bidang ekonomi negara

- contoh surat permohonan pampasan

- contoh lukisan pemandangan tepi pantai hitam putih

- nama chocolate royce recipe

- cara nak beli kereta honda

- big data international group tipu

- mohon in english

- bekas hantaran kayu pallet

- penyakit kulit bengkak merah

- jenis.jenis cop nama

- youtube salam untuk dia

- sun suria city

- good distribution practice malaysia